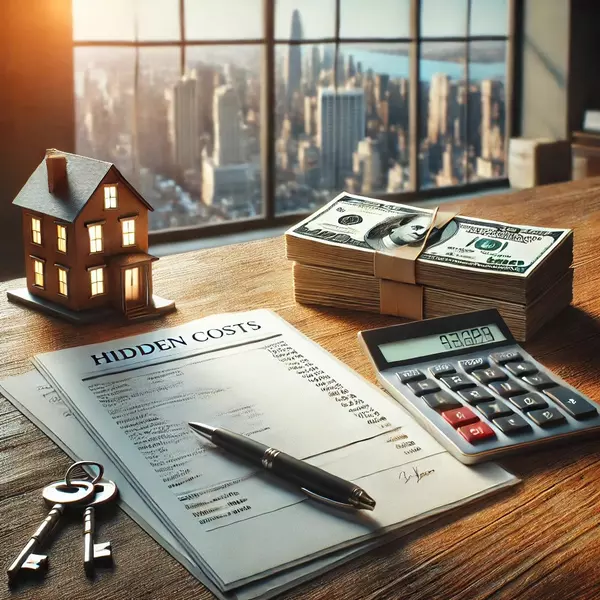

Closing Costs: Condos & Townhouses

CONDOMINIUM APARTMENTS AND TOWNHOUSE CLOSING COSTS FOR THE SELLER:

Broker

6%

Own Attorney

$1,250.00 and up

Move-out Deposit

$500.00

New York Transfer Tax

1% of price up to $500,000.00; and 1.425% of price over $500,001.00 (Paid by seller, except sale by sponsor)

Miscellaneous Title Fees

$200

Payoff Bank Attorney

$400+

CONDOMINIUM APARTMENTS AND TOWNHOUSE CLOSING COSTS FOR THE BUYER:

Attorney

$1,250 and up

BANK FEES:

Points

0 to 2.5% of loan value (optional)

Applications,credit check

$500+

Bank attorney

$750-$900

Short-term

One Month

Bank Escrows

2-6 Months

Bank underwriting Fees

$350

Appraisal Fees

$300-$750 (dependent on the price of the apartment)

Recording Fees

$400

Mortgage Tax

1.8% of amount of mortgage on loans Under $500,000;and 1.925% of amount of mortgage on loans over $500,001

Fee Title Insurance

Approx $675 per $100,000

Mortgage Title Insurance

Approx $500 per $100,000

Violation Search

$275+

Managing Agent Fee

$250+

Common Charge Adjustment

1 Month

Real Estate Tax Adjustment

1 to 3 Months

Mansion Tax

1% where price exceeds $1,000,000

Costs can change and vary for some transactions. All information is subject to errors, omissions and changes in facts or circumstances. Always consult your attorney before signing a contract.

Check with bank/mortgage broker for additional fees. New York State Law requires a written letter of engagement if the legal fee will exceed $3,000. Non New York State residents should procure exemption for state transfer tax forms (TP584). These are only estimates. Please confirm closing costs for specific transactions with your attorney and/or mortgage representative.

Categories

Recent Posts